A stationary time series is one whose statistical properties do not change over time. Many classical time series models (e.g., ARIMA, SARIMA) assume stationarity. Non-stationary data can lead to misleading results expecially in Time Series Forecasting.

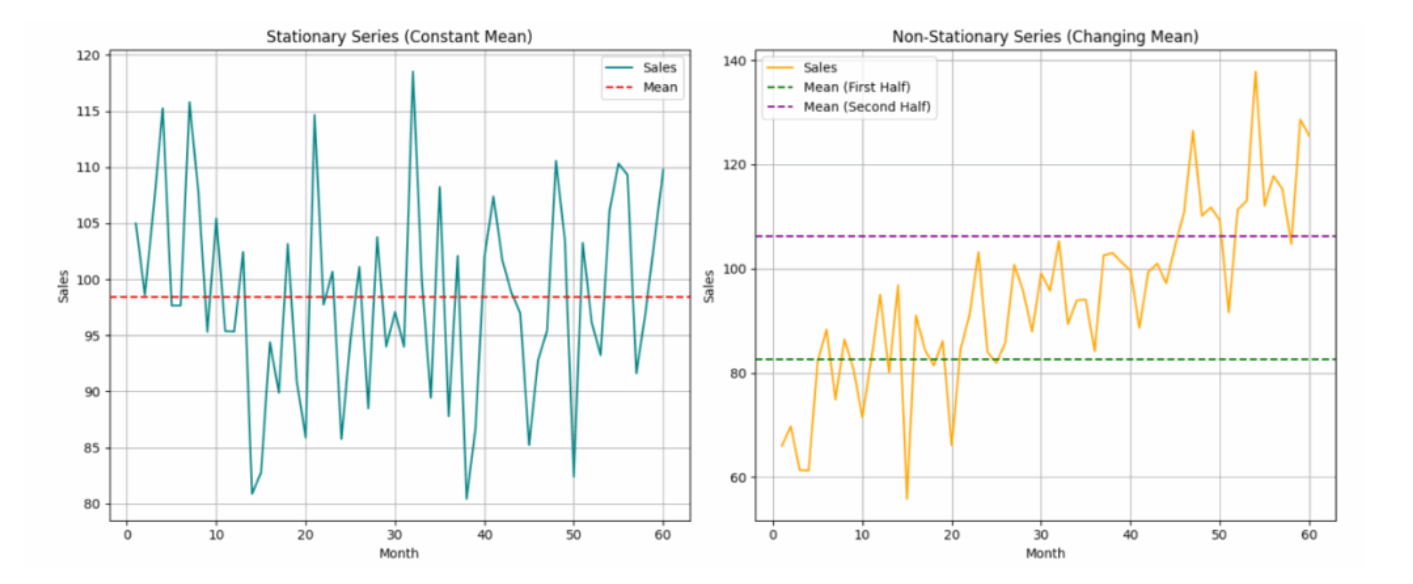

This means the process has the same behavior regardless of when you observe it. Checking a series’ stationarity is important because most time series methods do not model non-stationary data effectively. “Non-stationary” is a term that means the trend in the data is not mean-reverting - it continues steadily upwards or downwards throughout the series’ timespan.

Formally, a time series is stationary if:

- The mean is constant: for all .

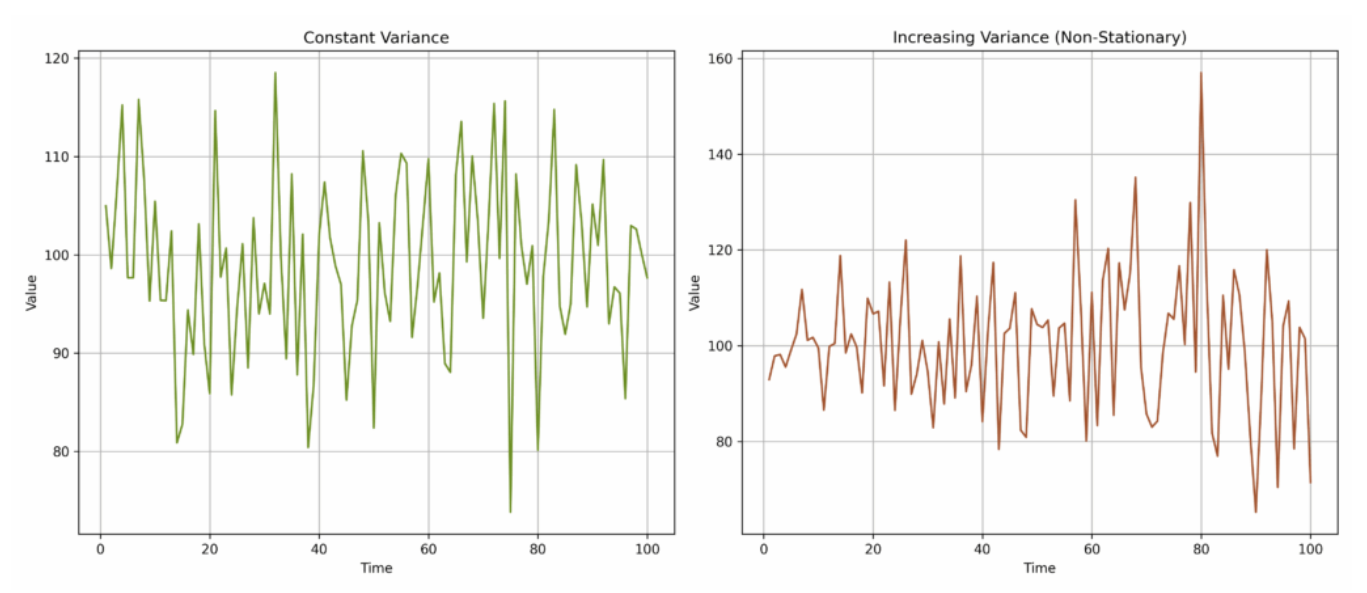

- The variance is constant: for all (the spread of data). If the time series goes up and down by similar amounts throughout the series, then it is said to have Constant Variance. More spread

- The autocovariance depends only on the lag , not on the specific time : . If the relationship between values depends only on the gap between them, regardless of when they occur, then there is Constant Autocovariance.

Types of stationarity

- Strict stationarity: The entire distribution of the process is invariant to shifts in time (all moments remain constant).

- Weak (or covariance) stationarity: Only the first two moments (mean, variance, covariance) are invariant. This weaker definition is often sufficient for models like ARIMA.

Examples

Stationary: White noise (mean = 0, variance constant).

Non-stationary:

- Series with a trend (e.g., increasing sales over time).

- Series with changing variance (e.g., volatility clustering in finance).

- Series with seasonality (patterns repeating over time).

Transformations to get Stationarity

Common Data Transformation to achieve stationarity include:

- STL Decomposition

- Log transformation (to stabilize variance)

- Detrending or deseasonalising

Tests for Stationarity

Practical checks:

- An easy way to check for constant mean and variance is to chop up the data into separate chunks.

- Then, one calculates statistics for each chunk, and compare them.

- Large deviations in either the mean or the variance among chunks might indicate that the time series is nonstationary.

- ADF Test & KPSS Test: Augmented Dickey-Fuller test give statistical justification to what our eyes see. If the the p-value is not less than 0.05, we must assume the series is non-stationary.

- Visual inspection with STL Decomposition

- ACF Plots

Related

- Decomposition in Time Series

- One time events (Interventions) be removed (think Covids impact of stock data). See Intervention Analysis.

- Decomposition in Time Series

Resources: